- Have any questions?

- +49 (0) 211 – 55 94 30

- info@ilasnetwork.org

INCOTERMS 2020 : What are the important points of the revision?

13th January 2020

November 2020 – ILAS Virtual Conference

14th December 2020THE SRL: a company without capital and whose securities are likely to be transferred freely

THE SRL: a company without capital and whose securities are likely to be transferred freely

Summary

1.1 Flexibility

1.2 Dividend distribution to shareholders.

1.3. Resignation for social heritage

2.1. Share categories

2.2. Accessibility

2.3. Buyback of own shares

2.4. Additional contributions

2.5. Disappearance of titles

3.1. Financial assistance

3.2. Business Continuity: Alarm Bell Procedure

Introduction

1.-The limited liability company is the most common form of company in Luxembourg as in Belgium.

The limited liability partnership has experienced significant revenues with the new Code of companies and associations (below CSA).

We will address the following themes. First, we will analyze a substantial change, the disappearance of minimum capital (Chapter I). Then we will focus on titles, the nature and their accessibility (Chapter II); we will avoid the necessary maintenance of the sound financial situation of the company (Chapter III) and to conclude briefly on the transitory law (Chapter IV).

CHAPTER I. CONTRIBUTIONS

2.- The notion of capital has quite simply disappeared; a prescriptive approach (minimum capital) has given way to a more economical approach (1.1); economic rules govern the distribution of profits (1.2) while the Code organizes the possibility of leaving the company at the cost of the company’s assets (1.3).

1.1.FLEXIBILITY

2.- This flexibility is manifested by the abandonment of the capital requirement (a). But a more detailed financial plan showing the viability of the project will be prescribed (b). We will then see the type of inputs; here, too, greater flexibility will be required(c). Finally, this new approach will go hand in hand with a responsibility of the founders. (D)d).

a) Exit the minimum capital, welcome to the contributions.

3.- For the legislator, capital no longer fulfilled its function of protecting creditors; indeed, the presence of capital does not reassure creditors that there is sufficient liquidity to meet their commitments; it is therefore necessary to take into account the economic dynamics that underpinned the capital requirement. This abandonment of capital is also found in other countries.

This requirement of minimum capital is replaced by the requirement of sufficient equity to carry out the projected activity, which leads to greater accountability of the founders; other financial means can be taken into account in the assessment of the capital necessary for the activity, such as loans for example; it will also be appropriate in this assessment of the necessary equity to respect the continuity of the company.

Contributions are required; they are in principle to be released, but they can be deviated from.

The constituent statement will take up:

In a way, it is the notion of contribution that takes up the notion of capital.

b) Financial plan.

4.- In line with the economic dynamics mentioned above, the creditor guarantee will come more from a good financial projection of the company's activities than from a minimum capital. A financial plan was already required but many of them were quite rudimentary. That's why the code carefully focuses on the financial plan and details its content. This initiative is to be welcomed.

The plan will include:

This financial plan becomes a real business plan.The legislator wants the founders to have thought carefully about the project's chances of success and the evolution of the company's profitability, which is a laudable goal.

c) Contributions.

5. - It is a value made available by a partner. In return, he will receive shares.

The reports are listed on the balance sheet instead of the capital. Contributions must be fully subscribed. If, in principle, the contributions are to be fully released, this is an alternate rule. In addition, the subscription of contribution by the company itself remains prohibited.

There are different types of input.

i) Cash contributions.

These are paid into a special account as in the old corporate code. What is interesting in practice is that the account can be a bank account in the European Economic Area and not just in Belgium. So, a company with its head office in Lithuania can set up a subsidiary company in Belgium and open an account in Lithuania for that subsidiary.

Contributions can also be a claim or contributions in foreign currency.

(ii) In kind contributions

6.- A contribution in kind includes elements that can be assessed economically. It covers any tangible and intangible property other than cash contributions.

The evaluation must be done by the founders who write a project submitted to the assessment of a corporate auditor; the latter issues his opinion and the founders explain why they follow or deviate from the opinion of the auditor. One can question the merits of this requirement since, in any event, there is no longer a minimum capital requirement.

But no doubt the legislator wants each shareholder to be able to objectively assess what the other has brought in the proper distribution of rights between them.

iii) Contributions in the form of services

7.-The Code introduces contributions in the form of services and it is to be welcomed, as this shows the desire to extend the options to companies to be built up and to value human capital; these contributions can be valuable for start-ups. l

Contributions in services can be defined as" commitment to work or service." Preparatory works show that this is an in-kind contribution of services to be rendered. It must be evaluated as any in-kind input.

This assessment will be more difficult as it is a matter of assessing services to be performed.

The founders must state the value of the contribution to company, a description of each contribution and a reasoned evaluation. The auditor must comment on this report.

The Code provides some additional rules in this area.The person who brings his activity must account for the profits related to the activity brought in and can also compete with the company as an independent and not as part of a subordination link.

The release of the contribution will take place as the work is carried out. The cession of the shares linked to this contribution will be allowed; what if the performance of the services takes place intuitu personae if the contribution is not fully released? In other words, a professional specializing in the company's activity receives a contribution in kind in exchange for a very specialized work that he undertakes to do; while he is in the middle of this work, he sells his shares half paid to a third party who has no competence in the work to be done; the best in this case will be to prohibit the sale of the shares before the end of the work.

If the performance proves impossible (death, possibly coronavirus crisis), the shares are null and void. If the execution is temporarily impossible,(disease, possibly coronavirus crisis) the rights attached to the shares are suspended. If the execution is flawed, the claimant will be liable for damages.

But the parties are free to contractualize the system of contributions in services in particular on the performance of benefits; thus, the explanatory statement of the law recommends the inclusion in the statutes of a termination clause providing that, in the event of fault, shares representing the contribution of services are annulled in whole or in part for the future.

8.-Contributions in services will be subject to a delicate accounting and tax impact.

Accounting approach.

It will often be considered an off-balance sheet asset. The Accounting Standards Committee recalled that recognition of an asset requires that it be identifiable and can generate future economic benefits. It considered that it was difficult to consider as a contribution in the accounting sense of the term, an activity that will not generate assets (such as participation for a few hours in the sale of goods to be delivered by the company), this categorization was criticized because the services to be performed have a value and constitute a real contribution.

The report distinguishes between the promise of services or work on the one hand, and the realization of these.

With regard to the promise to carry out work, the Committee considers that it should not be included in the equity of the balance sheet. As a result, "a company's rights over the person making the contribution in services must be included in the off-balance sheet rights and commitments and must therefore be counted in Class 0."

Personally, we believe that these inputs should be valued as contributions; until further notice, it is a debt held by the company to a partner, and the debt may be valued as any other contribution; It was clear that claims could otherwise be made to the company as cash contributions; a fortiori as contributions in services if the claim consists of work.

With regard to the work carried out, the committee is more nuanced and refers the matter to the assessment of the governing body. It may decide to account for them off-balance sheet as for the promise of work or services; it may also consider that "the release of the contribution gives rise to an entry into the equity as the asset is created ”

Tax approach.

Paradoxically enough, at the level of the Income Tax Code, the CSA's accompanying tax law does not take into account these contributions in service for the formation of equity, in the fiscal sense of the term. Article 2,1, 6, 2) of this Code defines the company's capital as follows: "2) for the forms of companies for which the Belgian or foreign law governing the company does not provide for a concept analogous [to the capital of a limited company], the equity of the company as stipulated by Belgian or foreign law governing the company, to the extent that they are formed by contributions in cash or in kind, other than contributions in services»

This exclusion is justified by the difficulty of assessing inputs into industry.

These accounting and tax approaches illustrate the unwarranted mistrust that some institutions have about in-kind inputs and more specifically the contribution of services. What about the contribution in services made before the company was formed? This activity may be evaluated as part of an in-kind contribution.

The quasi--contributions

A sale of assets by a partner to the company shortly after the incorporation of the company is defined as a quasi-contribution; it is indeed a disguised contribution. To avoid circumventing the rules for evaluating inputs by an auditor r, the quasi-contributions were under the old Code, the subject of an evaluation by a reviewer. Paradoxically enough, the new Code no longer prescribes this assessment, probably because the notion of capital has disappeared; whereas in-kind contributions are still subject to evaluation by an auditor.

d) Liability of the founders.

9.- Who are they?

The founders are in principle the persons who appear to the act of foundatio but accommodations are envisaged.

Thus, some people may be pure underwriters and therefore assume no responsibility with the temperament that a third of the securities must be held by founders.

Under Article 5:15 CSA, the founders are guarantors of the unconditional underwriting of the securities; they are responsible for the release of the shares of which they are underwriters as well as for the release of the shares, directly or by means of certificates, in violation of Article 5:6 CSA.

The founders may be liable for the harm resulting from the nullity of the company, the absence or falsity of the mandatory references to the constitution or the overvaluation of in-kind inputs.

Founders are also responsible if they give their company a name identical or similar to that of an existing company.

The founders are responsible if the company does not have sufficient means to conduct its activities during the first two years of its existence and in the event of bankruptcy within three years of the acquisition of legal personality.

In this case, the responsibility of the founders will not necessarily be total in relation to the deficit suffered; it will be fixed in the proportion set by the judge.

Responsibility is now extended to all companies, including civil societies.

1.2. DISTRIBUTION OF PROFITS TO SHAREHOLDERS

10.- These are known to be both the last to have access to the assets of the company (residual claimant) while having the decision-making power over the distribution of profits. The old Code prohibited the levying of unavailable capital and reserves in the distribution to shareholders.

The new Code takes a more cost-effective and coherent approach.

Some rules show greater flexibility.

Thus, the company can distribute dividends relating not only to the previous year but also to the current exercise. This is not a down payment but a final distribution. The jurisdiction to decide such distribution rests with the general assembly, which can delegate it to the governing body.

This flexibility is associated with more precise economic criteria.

a) Double test.

11.- Any distribution will be subject to a net asset test and a liquidity test.

THE NET ACTIVE TEST: No distribution will be allowed if net assets are negative; net assets are the total assets from which provisions and debts are subtracted.

LIQUIDITE TEST: The company must be able to pay the debts for a period of at least twelve months.

The decision must be justified by the governing body.

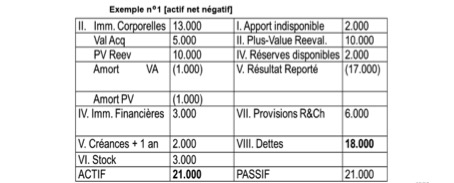

We can take a few examples.

Net assets are:

$21,000 to be subtracted

-18,000 euros as debts

- 6,000 euros of provisions.

Therefore, net assets are negative and no distribution is possible.

Unavailable capital.

12.-If the company has equity that is legally or statutorily unavailable (for example, in the event of the company's share buyback) no distribution can be made if the net asset is less than the amount of that unavailable equity or becomes so as a result of such distribution. For the application of this provision, the unamortized portion of the revaluation capital gain is deemed unavailable.

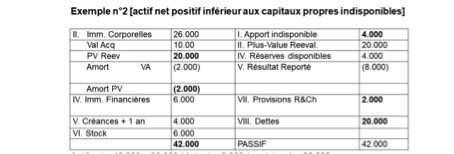

Example 2. positive net assets below unavailable equity

In this case, the net assets of 42,000 euros exceed the debts (20,000euros) and the provisions (2,000 euros). But if we withdraw the unavailable contributions (4.000) and the most efficient unamoritized revaluation (20,000 -2,000-18,000euros), no sum can be distributed.

Example 3. positive net assets in excess of shareholders' equity not available for distribution

In this case, the net assets (40,000 euros) from which debts (4,000 euros) and provisions (2,000 euros) are subtracted, provisions amounts to 34,000 euros; the possible distribution will be possible, once subtracted from this amount of 34,000 euros the unavailable contributions (4,000 euros) and the non-depreciable revalutation gains (16,000 euros) or 20,000 more revaluation value less the amortization of this added value.

i.e. 34,000-4,000-16,000 = 14,000

The application of these tests is extended to other hypotheses, namely in the event of a share buyback, withdrawal of a shareholder, financial assistance. Here again the new rules are based on relevant economic bases.

b) What is the penalty for non-compliance?.

13.-In the event of violation of the solvency test, the liability of the shareholders cannot be incurred; nor that of the governing body since the distribution decision belongs to the general meeting.

With regard to the liquidity test, the directors will be jointly responsible if they knew or had to know that, as a result of the distribution, the company would clearly no longer be able to pay its debts. The term clearly is a safeguard to avoid too automatic a conviction of directors and shows that the judge's control is marginal. To avoid joint and several liability, the director must prove that he was not involved in the decision and that he denounced the infringement to the members of the governing body. The company will be able to apply for a refund to shareholders of the sums distributed in this way, whether these shareholders are of good or bad faith.

The Belgian scheme is thus modelled on the Dutch BV (private company) scheme, which aims to bring the distribution of profits closer into line with the economic reality of the company.

1.3. RESIGNATION AND EXCLUSION FROM SOCIAL ASSETS

1.3.1. Resignation.

14.- This possibility is a novelty justified by the disappearance of social capital. It must be provided for by the statutes.

This mechanism was known in the old Code only for cooperative companies and within the limits of variable capital.

A SPRL could buy back its own shares, but it had to take the initiative and not the partners.

A shareholder - this faculty is reserved for shareholders exclusively and not to holders of other securities - may withdraw from the company and be reimbursed from its share in the social assets taking over the cooperative company's system but leaving greater statutory freedom.

This resignation requires compliance with certain rules under section 5:154, '1', of the CSA:

The statutes may deviate from the last three rules above set out but not the first. For example, the statutes may provide for resignation only for certain categories of securities and not for others. There is no reason why the resignation should be allowed and not the exclusion that we will discuss in the next paragraph. It could also be expected that resignation is permitted for the first three years provided that the resigning shareholders are not the founders.

The resignation may take place at any time; the six months deadline was previously mandatory in limited liability cooperative societies, it is now additional. The statutes may provide for exit arrangements, including windows, to make the output more efficient. The resignation will take effect on the last day of the sixth month of the fiscal year.

15.- How is the value of the share calculated?

This will be the amount actually released and not yet repaid for these shares without this amount being greater than the amount of the net asset value of the share as it results from the last approved annual accounts. This value is calculated logically by dividing the net assets by the number of shares issued (taking into account the appropriate share classes.) The shareholder must be paid within one month of the decision being taken.

The amount paid to the shareholder, corresponding to a distribution, will comply with the net asset and liquidity tests described above. The purpose was to prevent a shareholder from leaving the vessel just before the sinking, namely the company's insolvency.

It also assumes a notarized act which is likely to add to the procedure, while the new legislation wants to strengthen the flexibility of the functioning of company.

This new mechanism thus approaches the SRL of the cooperative company, which is known to be characterized by the variability of capital.

1.3.2. Exclusion

16.- The statutes may provide that a shareholder may be excluded for just reasons or for any other reason he foresees. For the conditions of implementation, the same mandatory rules will be applied in the resignation regime.

What procedure should be followed?

A reasoned proposal is sent to the shareholder by email unless the shareholder chooses to contact the company by regular mail, in which case the proposal is sent by registered mail.

The shareholder can make his comments, and it is then up to the general assembly itself to decide; the shareholder can be heard and the decision of the general assembly must be reasoned.

The shares are valued according to the same rules as those applicable to the resignation of the social assets.

1.3.3. Alleged resignation at the expense of social assets.

17.- The Code allows the statutes to provide that the shareholder is presumed to resign in the event of bankruptcy, liquidation or prohibition. Similarly, a quality criterion is inserted, namely that the shareholder who no longer meets the conditions required by the statutes is deemed to be resigning. This clause amounts to an express termination clause in contractual matters.

These provisions give the drafters of the statutes a great deal of freedom and the last clause is likely to lead to a lot of challenges when implemented.

The governing body will have to report to the general assembly the resignations. At the very least, this report should contain the identity of the shareholders, the number and class of shares held by the resigning shareholder, the amount paid, the terms of the payment, the number of rejected applications and the reasons for the refusal. This rule, in our view, must also apply to the alleged resignation.

It should be noted that the CSA organizes the departure of shareholders but does not provide specific regulations for the admission of new shareholders, as the cooperative company scheme does. Accreditation must be granted in the SRL, unless statutory provisions, by at least half of the shareholders representing at least three-quarters of the shares.

CHAPTER II. THE TITLES

18.- The new code introduces new securities categories into the SRL (2.1.); it makes their cessibility (2.2.) more flexible (2.2.) as well as the repurchase of own shares by the company ( 2.3. ) ; What about the new contributions made during the life of the company (2.4); what if the securities disappear (2.5)?

2.1.TITLE CATEGORIES AND REGISTER.

a) Title categories.

19.- We are now talking about the shares in the SRL.

The latter may issue all kinds type of security (including convertible bonds and subscription rights) The concept of an issue premium is abolished since the concept of capital has disappeared. It may issue certificates securities or profit shares. The non-voting share remains maintained. Furthermore, the securities may be listed on the stock exchange.

The capital was used to secure the rights of shareholders whereas a shareholder who held 51% of the share capital acquired control of the company. "The disappearance of capital breaks the link between the value of the contribution and the rights attached to the shares." In other words, the parties can freely determine the rights that are attached to each action.

This is how the multi-voting system is henceforth recognized.

No limitations are related to this multiple character; a title can give 500 votes whereas another share can only give one vote.

Various incentives may be granted to each of these titles; for example, a veto or a multiple right to vote for some decisions and not for others.

b) Register.

20.- The CSA provides for three categories of registers; the register of registered shares, the register of registered bonds, and, this is a novelty, the register of registered securities entitled to shares. In addition, a register must be kept for each class of securities that the shareholders have designed. Since each security does not entitle the same power, the contents of the registers must allow the rights of each shareholder to be established during the vote or when the dividends are distributed.

In the old Code, title ownership was established by registration in the register; this rule was quite dangerous because the falsification or creation of a parallel register was easy; therefore the rule was uncertain.

The new Code stipulates that registration in the register of registered securities constitutes a rebuttable presumption of ownership. Evidence to the contrary may be reported by all legal channels. This more coherent adaptation to the legal principles of evidence law should be welcomed.

2.2. Cessibility.

21.-The great distinction between the limited company and the private company has always been that, in the first case, the shares are freely transferable, while in the second, the shares cannot be sold without the approval of the other shareholders; the private company is also called in the Netherlands, a closed company (Besloten vennootschap).

The CSA also provides that the eligibility of securities is subject to approval. It has already been stated that the approval must, unless otherwise stated, be approved by at least half of the shareholders who own at least three-quarters of the shares, subject to the deduction of the shares the transfer of which is proposed.

Accreditation must be established in writing; the ceding candidate must disclose to the other shareholders or the governing body the number of shares to be sold, the identity of the assignee and the proposed price. A written consent procedure may be provided. The Code does not set a time limit within which consent must be given. Refusal of approval may result in an appeal to the company's court, if it is arbitrary.

In the event of the sale of undrafted shares, assignor and assignee are jointly required to pay the balance to be released to the company.

22.- The novelty lies in the fact that statutory provisions can be provided for the transfer of securities free.

Total freedom but also more restrictive conditions to the ordinary regime are possible. The Code does not provide a limiting regime for the inalienability or accreditation clauses; the common law has all its effects, while stressing that these clauses cannot be incompatible with the legal or statutory provisions in this field. In the case of listed companies, special rules will be applied.

The law also provides for assumptions of forced transfer:

In the second proceeding, a shareholder may, for just good reasons, apply in court that the shareholders who are the originators of these just reasons be ordered to buy back the securities for payment of the price and within the time to be determined by the judge.

2.3. Buyback of own shares.

a) What are the conditions?

23.- They are:

b) What happens to the repurchased shares?

24.- The company may cancel or retain the securities but, if retained, the rights to the acquired shares are suspended, and the securities are therefore part of the unavailable reserve; the right to the dividend also lapses. The obligation to dispose of securities within two years is waived; it is now a right to alienate.

The disposal of these shares is subject to the conditions of the amendment of the statutes. In addition, the right of preference will be, which seems consistent, reserved for existing shareholders. Moreover, the company’s pawn of its own securities is no longer subject to any regulation except that of conflicts of interest.

2.4. Additional contributions.

These can be achieved with or without issuing new shares.

2.4.1. Contributions without issue of new shares.

25.- These contributions can be accepted, by a simple majority, by the general assembly. Since the company is without capital, there is no justification for changing the statutes in the event of a new contribution, without issuing new shares.

These contributions do not change the number of shares or the decision-making power in the company.

The decision must be, surprisingly, determined by authentic act. The governing body will be responsible for accounting for these contributions in the section planned for this operation. This will allow third parties to be informed of this contribution.

2.4.2. Contributions with equity issues.

26.- These require a prior report from the governing body that justifies the issue price and the consequences on the property and social rights of shareholders.

Where an auditor is appointed, the auditor prepares a report on the confidentiality and sufficiency of the financial and accounting data contained in the report of the governing body.

The same reports must be written in the event of the issuance of convertible bonds or subscription rights. In addition, the report of the governing body must, in view of the specific nature of the transaction, justify the proposed transaction.

The General Assembly decides according to the conditions required for the statutory amendments since the issuance of shares implies a change in the statutes.

The absence of the aforementioned reports constitutes a cause of nullity of the decision of the general assembly unless the general assembly renounces it by unanimous decision; however, this waiver is not possible in the case of in-kind contributions. This waiver is also not permitted in the event of the issuance of convertible bonds or subscription rights "due to the delay between the issuance and the conversion or exercise of the right.".

27.- New shares must be fairly logically subscribed.

The option of taking out new shares is reserved for the conditions of approval to acquire new shares. The company will not be able to subscribe to its own shares or certificates relating to such shares, either directly, either by a subsidiary company or by a lent name. In the event of subscription by them, the rights relating to these shares or certificates are suspended.

This prohibition will not apply in the event of a subscription by a subsidiary company which, as a professional securities operator, is a stock exchange company or a credit institution.

The shares must be fully liberated as in the constitution of the company, unless the statutes are otherwise required. Where the decision to issue the securities and their subscription are not concurrent, the subscription is found by an authentic deed drawn up at the request of the governing body or one or more directors or agents delegated for this purpose, and this, on presentation of the documents supporting the transaction.

The same is true if new shares are issued as a result of the conversion of convertible bonds, a substitution of bonds into shares or the underwriting of shares following the exercise of a subscription right. These transactions must be determined by authentic deed, thus amending the statutory provisions relating to the number of shares of the company and thus confers the status of shareholder to the beneficiaries of the aforementioned transactions.

Cash contributions.

28.- The right of preference of existing shareholders is maintained. This may be limited or removed in the social interest by the general assembly called upon to rule on the issuance of new shares; this proposal must be indicated in the summons and the decision will be taken according to the conditions prescribed for the amendment of the statutes.

The members of the general assembly receive beforehand the report of the governing body which outlines the reasons for this limitation and informs of the consequences on the rights of shareholders. The auditor or, failing that, an external auditor or accountant, will assess whether the financial data in this report are accurate and sufficient.

Where the beneficiaries are not staff members, the governing body will mention in its report the identity of the beneficiaries and will justify in detail the transaction and the issue price in the social interest, taking into account the financial situation of the company, the identity of the beneficiaries and the nature and extent of their contribution. The company auditor or, failing that, an external auditor or external accountant will provide a detailed assessment of the justification for the issue price.

It is therefore clear that the limitation or removal of the right of preference is subject to significant safeguards.

Any person who is entitled to the right of preference and who already holds securities of the company to which more than 10% of the voting rights are attached must abstain.

To these titles must be added the titles held by a person acting on his behalf but on behalf of the first beneficiary, by any person linked to that first beneficiary or by any person acting in concert. What do you mean by a person acting together? These are individuals who, in the context of a takeover bid, cooperate with the offeror, the target company or other persons on the basis of an agreement, in order to gain control of the target company; they are also those who have reached an agreement on the exercise of the right to vote in order to carry out a sustainable common policy in company.

2.5 Disappearance of titles.

29.-This is true in various hypotheses:

(a) Shares have been awarded in compensation for a contribution in services : the shares awarded in compensation for a contribution in service whose performance has become definitively impossible become obsolete.

(b) The securities are cancelled by the acquisition their own shares by the company.

(c) The resignation or exclusion of a shareholder.

The managing body is responsible for updating the register of shares. As far as shares have become obsolete, nothing is specifically planned, but since the update with the number of shares held by each shareholder is the responsibility of the management body, this logically includes the fate of the out-of-date shares.

CHAPTER III. MAINTAINING CAPITAL

3.1. FINANCIAL ASSISTANCE.

30.-What is financial assistance?

It consists of advances of funds, loans or security made by the company for the acquisition of its shares by third parties. The rules originating from the Code of the companies taken over from Article 629 of this Code, which prohibited financial assistance, had been criticized as a hindrance to mergers and acquisitions; they were somewhat simplified. Thus the pawning of shares is no longer subject to this procedure and is allowed with respect to the rules regarding conflict of interest. In addition, the criminal penalty for non-compliance with these provisions has been abolished.

What are the conditions for implementation?

Firstly, it implies a decision of the general assembly taken under the conditions required for the amendment of the statutes, on the report of the governing body. The general assembly decides on the conditions of majority and quorum required for the amendment of the statutes. The management body must justify it in particular in view of solvency and liquidity risks. In other words, the operation can only be carried out with means that can be distributed.

The sums allocated to financial assistance are taken over in an unavailable reserve, which can be reduced if financial assistance decreases.

The intervention of the general assembly is not required if the financial assistance is intended for a member of the staff of the company or a related company, or to a company whose majority of the shares belong to the staff members.

The new Code stipulates that registration in the register of registered securities constitutes a rebuttable presumption of ownership. Evidence to the contrary may be reported by all legal channels. This more coherent adaptation to the legal principles of evidence law should be welcomed.

What's the penalty?

The directors will be liable if the conditions mentioned above are not met.

3.2. Business continuity: alarm bells.

31.- The proceeding is adapted because of the disappearance of the notion of capital.

What are the conditions under which this procedure should be implemented? First, when the net assets are negative or likely to be negative. The concept of risk ( likelyhood) reinforces the responsibility of the management body, which requires a broader appreciation on the part of that organ.

Secondly, the alarm bells mechanism must be implemented if it is no longer certain that the company will be able to pay its debts as they mature, at least within twelve months. This corresponds to the liquidity test studied above. But the threshold under which the alarm bell procedure must be implemented is no longer when net assets are below half of the share capital but when they reach the zero threshold.

The new Code provides for a more qualitative monitoring requirement since the governing body will have to keep a close eye on the company's liquidity. But the question is whether monitoring should be permanent; Mr. De Wolf writes: "Legal obligations do not require constant monitoring of applicable criteria, but only when conducting a check in connection with the establishment of annual accounts or a possible inter-average state of assets and liabilities. The governing body is not required to formally determine that neither of the criteria is met. This avoids imposing recurrent and unnecessary reporting obligations on companies that are in good financial health. »

32.- Which measures should be taken?

It is appropriate to call a general meeting within two months, which will hear the report of the management body; this report will propose solutions to ensure the continuity of the company, the dissolution being the ultimate solution. The process will be repeated every year as long as the situation persists. The old Code provided for the right for third parties to apply for dissolution in the event of a reduction in net assets to less than 6,200 euros; this right is not included in the CSA.

In the event of a breach of these obligations, the CSA provides, like the old Code, that the damage suffered by third parties is unless there is evidence to the contrary, presumed to result from this lack of summons.

CHAPTER IV. TRANSITIONAL LAW

33.- From 1 January 2020, the SPRL automatically becomes the SRL. The mandatory rules of the new Code will apply automatically. As of 1 January 2020, the BVBA automatically becomes a limited liability company (SRL). The mandatory rules of the new Code will apply automatically.

The paid-up capital and the legal reserve are automatically transformed into a contribution that is statutorily unavailable. In principle, they may not be distributed but may be allocated to directors' fees or dividends subject to the formalities to be complied with in the event of a change of the statutes (this is why they are called statutorily unavailable). The unpaid up capital becomes an uncalled contribution; if it is paid up, it will be added to the contributions that are statutorily unavailable.

As soon as the law was published, the articles of association could be adapted to the new law. The statutes must be adapted by 1 January 2024 at the latest. When adapting the articles of association, the company may convert the contributions not available in available reserves. It will be necessary to be attentive to the consequences that this conversion may have, in particular for the credit agreements entered into by the Company. Indeed, termination clauses in these agreements sometimes deal with the modification of the capital structure.

CONCLUSIONS

34. The new code is a real conceptual evolution; exit the capital so dear to Karl Marx... But behind increased flexibility, there is also greater accountability of directors; the means are freer but the results prescribed by law remain at least the same; When net assets are at risk of negative or liquidity situations are at risk of being compromised, the governing body must take various measures detailed above; predictability of older forms is therefore replaced by greater flexibility, but for which directors assume responsibility. Thus, failure to comply with the liquidity test can result in a heavy liability that may, in some cases, deter directors from taking entrepreneurial risks.

For a foreign company that comes to settle in Belgium, is it maybe better to have a minimum capital of 6,250 euros or not to have minimum capital but to have increased requirements in the head of the founders in terms of the viability of the project, this is a question whose answer is uncertain; we will see what the figures of creation of new companies will reveal at this level.

We can also welcome the concern to ensure the continuity of companies in a society where sustainability or sustainability is an important value. The desire to reconcile economic and legal principles can only be welcomed.

Finally, the reconciliation between the SRL and the SC is illustrated in particular by the possibility for a shareholder to resign from the company as is the case in cooperative companies.